boulder co sales tax rate 2020

It also contains contact information for all self-collected jurisdictions. The sales tax jurisdiction name is Santa Cruz County Tourism Marketing District which may refer to a local government division.

Should Boulder Do Away With Sales Tax On Groceries Boulder Beat

The December 2020 total local sales tax rate was 8845.

. The current total local sales tax rate in Boulder CO is 4985. The citys Sales Use Tax team manages business licensing sales tax use and other tax filings construction use tax reconciliation returns and various tax auditing functions. The 8845 sales tax rate in boulder consists of 29 colorado state sales tax 0985 boulder county sales tax 386 boulder tax and 11 special tax.

2055 lower than the maximum sales tax in CO The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax. The rate is comprised of individual voterapproved county sales and use tax ballot measures adopted to support county programs in conservaon transportaon offe nder management nonprofit capital. Boulder County CO Sales Tax Rate.

Para asistencia en español favor de mandarnos un email a. The assessment rate for commercial and industrial property is set at 29. The city of boulder will no longer mail returns after jan.

The 2020 boulder county sales and use tax rate is 0985. This is the total of state and county sales tax rates. Boulder County 0985 TOTAL Combined Sales Tax Rate in Longmont.

The County sales tax rate is. Month-Over-Month Change in Retail Taxable Sales. The ESD tax is on top of the City of Boulder sales tax rate of 386.

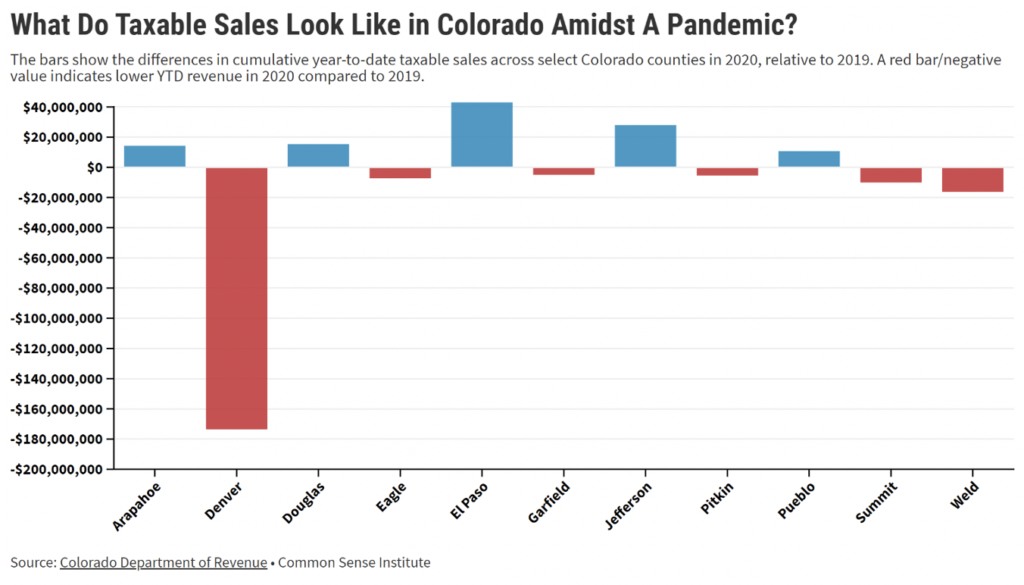

February 2020 retail sales tax revenue was down 12 compared to February 2019 revenue including audit revenue and the additional recreational marijuana sales tax. You can print a 9 sales tax table here. This document lists the sales and use tax rates for all Colorado cities counties and special districts.

The 9 sales tax rate in Boulder Creek consists of 6 California state sales tax 025 Santa Cruz County sales tax and 275 Special tax. Including audit revenue total sales and use tax increased from 2020 by 1657565 or 1829. There is no applicable city tax.

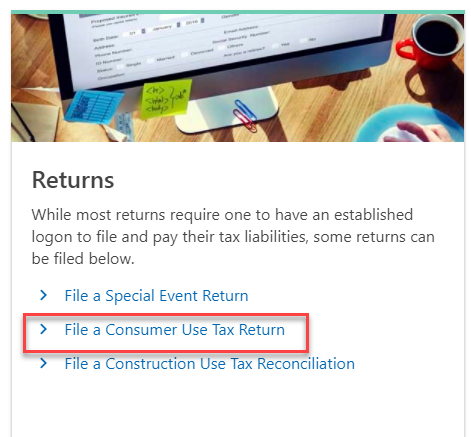

Boulder County Niwot Lid. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501. All returns must be filed on boulder online tax or can be.

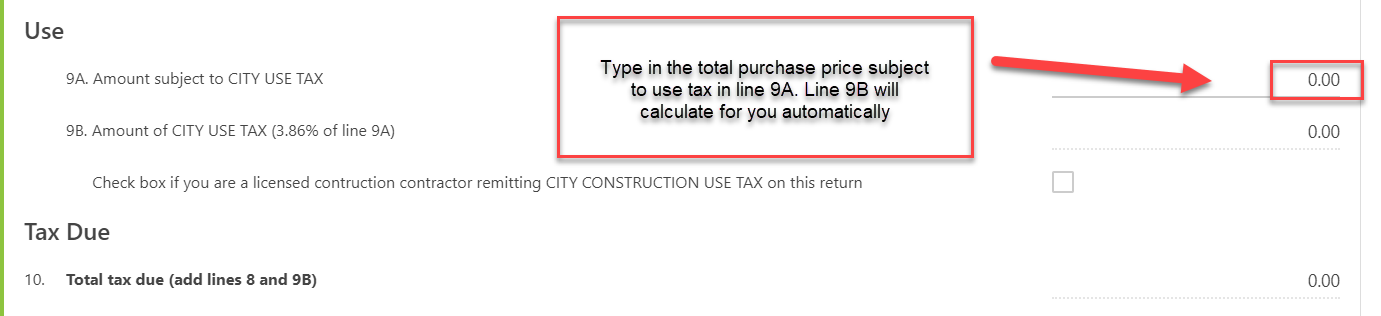

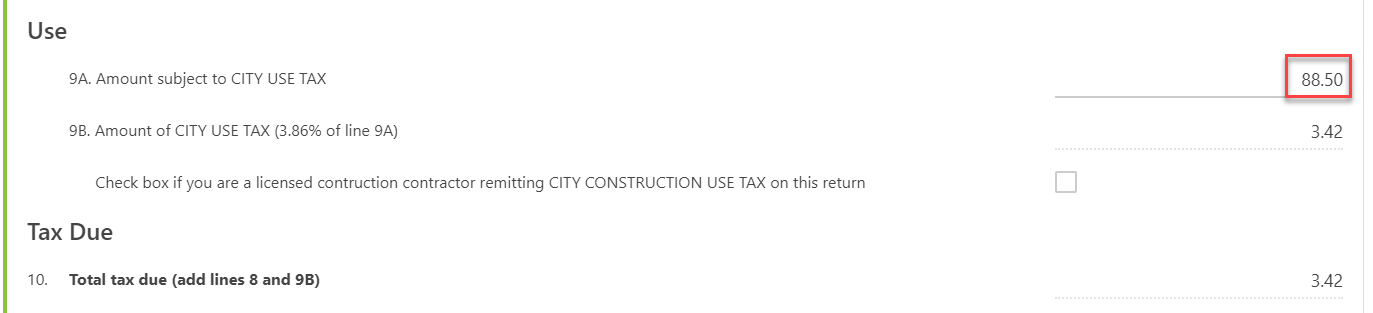

As of July 1 2020 tobacco retailers must collect and remit the 40 sales tax on Electronic Smoking Devices including any refill cartridge or any other ESD components. About City of Boulders Sales and Use Tax. Current City of Boulder use tax rate is.

Return the completed form in person 8-5 M-F or by mail. If your business is located in a self-collected jurisdiction you must apply for a sales tax account with that city. The December 2020 total local.

2055 lower than the maximum sales tax in co. The 2020 boulder county sales and use tax rate is 0985. This is the total of state county and city sales tax rates.

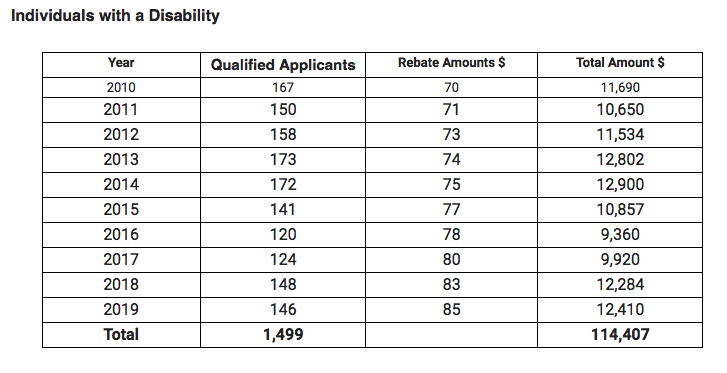

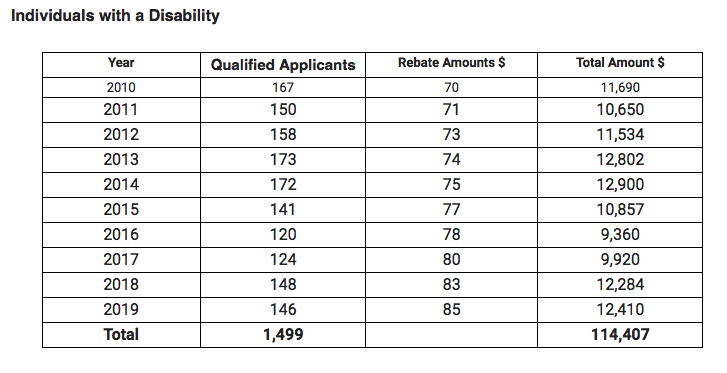

Sales Tax Boulder Countys Sales Tax Rate is 0985 for 2020 Sales tax is due on all retail transactions in addition to any applicable city and state taxes. July to December 2020. This is an improvement over May 2020 which declined by 188 compared to May 2019.

2055 lower than the maximum sales tax in co. The boulder colorado general sales tax rate is 29. Comparing activity for just the month of June June 2020 sales tax declined by 1352487 or -126 when compared to May 2019.

What is the sales tax rate in Boulder County. The minimum combined 2022 sales tax rate for Boulder County Colorado is 499. You can print a 8845 sales tax table here.

The Boulder County sales tax rate is 099. For tax rates in other cities see Colorado sales taxes by city and county. The Boulder sales tax rate is.

The current total local sales tax rate in Boulder County CO is 4985. The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Salestaxbouldercoloradogov o llamarnos a 303-441-4425.

The Colorado sales tax rate is currently. Special event vendor rate charts 2018 manual rate chart 2018 food for home consumption only 201 7 manual rate chart This is the total of state county and city sales tax rates. Current City of Boulder use tax rate is 386.

The 2018 United States Supreme Court decision in South Dakota v. Boulder County does not issue licenses for sales tax as the county sales tax is collected by. How to Apply for a Sales and Use Tax License.

This is the total of state county and city sales tax rates. The 2020 Boulder County sales and use tax rate is 0985. The minimum combined 2022 sales tax rate for Boulder Colorado is.

The 80303 boulder colorado general sales tax rate is 8845. Boulder CO Sales Tax Rate. The Colorado state sales tax rate is currently 29.

Sales And Use Tax City Of Boulder

Sales Tax Spreadsheet E Filing Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Taxes In Boulder The State Of Colorado

What Is Colorado S Sales Tax Discover The Colorado Sales Tax Per County

Cience Debuts At 31 In The Financial Times Americas Fastest Growing Companies 2020 Send2press Newswire Financial Times How To Start Conversations Financial

Nevada Sales Tax Guide For Businesses

Weld County Mill Levy Rate Continues To Shrink Especially Relative To Neighboring Counties Greeley Tribune

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute